Key Takeaways

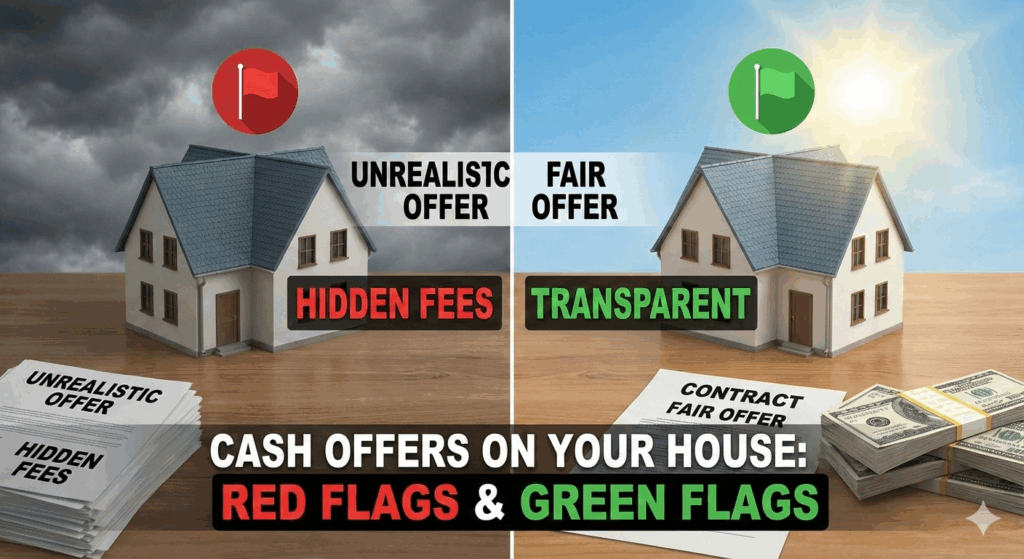

- Before divulging any personal details or putting pen to paper, always verify a buyer’s credentials.

- Real cash buyers will show funds and schedules.

- Quick replies, demands for payment before services, and convoluted agreements should raise suspicions.

- Effective communication, well-organized documentation, and realistic suggestions are good signs.

- Research the buyer and engage a real estate attorney to protect your interests.

Blog Objective

This guide is designed to convey all homeowners in recognizing genuine cash purchasers and steering clear of dangerous scams when considering cash offers. This can help you see the warning signs of a scam, so you can make smart decisions while selling your home.

Navigating the Fast Lane

Getting a cash offer on a house can be exhilarating, akin to hitting the jackpot. A quick closing, no debt problems, and instant cash flow are all things that attract a lot of sellers every year. Knowing how to distinguish between legitimate prospects and potential traps is key to safeguarding your most significant investment.

Did You Know?

The National Association of Realtors (NAR) estimates that approximately 28% of the existing home sales in the United States were made in cash-only transactions as of June 2024. This figure was the same as it was last month and even higher than the comparable one from the previous year. Source

Recognizing the Red Flags

Pressure Tactics and Rushed Decisions

Real buyers understand that you want to be thorough and careful. So, if someone is pressing you for a quick answer, creating a false sense of urgency, you should stay away. In fact, real deals give you enough time for review, taking opinions, and thoughtful consideration.

Requests for Upfront Fees

It is not a good idea to pay advance fees to professional cash home buyers. Some of the things you may be asked for are:

- Inspection costs

- Administrative charges

- Processing fees

- Title search expenses

These are the expenses that the buyer is responsible for.

Vague or Missing Documentation

Decent proposals are accompanied by solid, written agreements that specify the price, timeline, and contingencies. Real estate verbal agreements are worthless. So, you should ask for full documentation before you agree.

Significantly Below-Market Offers

It is standard for a cash offer on a house to be around 10-20% lower than the retail price of the property because of the seller’s savings and the convenience to the buyer. However, if the offer is drastically lower than the recent sales of the neighboring area, you should be wary. Check different sources to find out the value of your property before you agree to anything.

Identifying the Green Lights

Proof of Funds Documentation

It is not uncommon for buyers who really want to get the property to kindly provide bank statements, letters from banks, or investment account records as proof of their funds. This proof serves as confirmation that they can finalize the transaction without any financing hitches.

Professional Communication

Real money cash home buyers infrequently run away from their professional behaviors by such means as:

- Licensed real estate agents or attorneys

- Registered business addresses

- Verifiable phone numbers and emails

- Online reviews and testimonials

Transparent Transaction Process

Honest buyers will be the first ones to talk through the details with you. They explain the inspection processes, title work, and closing dates in a completely straightforward manner without any kind of trickery or hidden conditions.

Reasonable Timeline Expectations

In general, a cash sale is a lot quicker than one that is financed; however, the reasonable time for a transaction is considered to be 7-30 days. That is the time frame when title searches, inspections, and legal documentation can be done. Don’t take an offer at face value that implies closing in 24-48 hours unless the circumstances really allow such a quick getaway.

Benefits of All Cash Deals

Legitimate all cash offers can be risky, but, at the same time, they provide considerable advantages. Sellers often avoid appraisal contingencies, which often kill most of the financed deals but also throw away the uncertainty of loan approval and shorten the closing date from several months to just a few weeks.

Furthermore, all cash offers allow sellers to avoid selling disruptions, open house headaches, and property maintenance costs when properties stay on the market. For sellers who give speed and certainty more weight than maximum profit, cash transactions offer unparalleled convenience.

Your Blueprint for Success

It takes as much optimism as caution to successfully go through with quick cash offers. A good buyer will give you fair value, show transparency in their dealings, and offer a professional service, which altogether results in a transformed, refreshing experience.

Be confident, seek advice from professionals, and know that real offers can be checked out and will still stand. If the idea of a simple sale is something you want to go after, then “We Buy House As Is” services will be a great help for you to get a straightforward, stress-free deal. Besides performing your task wonderfully, they can accept your property regardless of its condition, take out the repair issue, and give you the cash that no sale through the real estate market can guarantee.

FAQs:

- Can cash sales close quickly?

Most legal cash sales close in 7-30 days, depending on title and inspection.

- Should I take a low-ball monetary offer?

Cash offers are usually 10–20% below market value owing to ease, but compare them to comparable sales and urgency.

- Must cash purchasers view homes?

For due diligence, cash buyers often visit homes but buy them as-is without repairs.

- Have all cash home buying firms been legit?

Don’t hire a company without checking BBB, web, and state license ratings.

- What papers should cash buyers provide?

Request proof of money, firm registration, client references, and a complete written contract with all terms.

Related posts:

- Understanding Cash Home Sale

- Guide to Selling your House for Cash

- Benefits of a Cash Offer

- How to Choose Reputable Cash Offer